Well, you guessed it. I'm here to post up even more bullish news! And, by bullish news, I obviously mean bearish news. After all, its Nouriel Roubini and Robert Shiller.

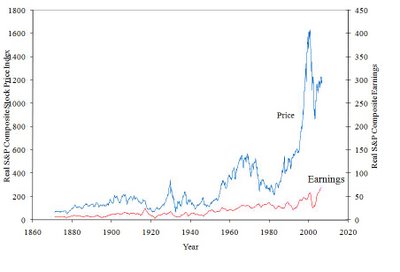

Here's the deal, Shiller has a set of S&P earnings and P/E ratios available in spreadsheet format here. Big hat tip to Cliff Küle for flagging this Shiller data and graphs to our attention. Cliff posts up some historical info, illustrated below. First, real S&P composite earnings:

Click to enlarge:

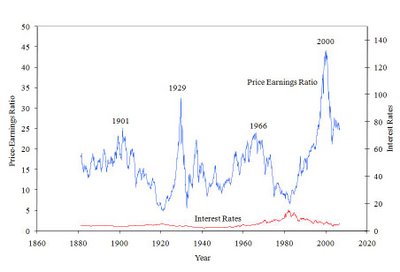

And secondly, historical P/E ratios and interest rates.

Click to enlarge:

By that historical data, you'd think that a 5 P/E could be achieved given the severity of everything that's happened. But, if you're not that apocalyptic, then maybe somewhere around 10x would be more appropriate. And, 'Dr. Doom' himself, Nouriel Roubini thinks that the S&P500 will see 600, which could be somewhat close to 10x by his measurement. Taken from Bloomberg,

The benchmark index for U.S. stocks would have to slump 12 percent from last week’s closing level to meet his forecast. Roubini is assuming that companies in the S&P 500 will report profit of $50 a share this year and investors will pay 12 times that for equities.

My main scenario is that it’s highly likely it goes to 600 or below,' Roubini said Thursday in an interview at the Chicago Board Options Exchange Risk Management Conference in Dana Point, California. A level of '500 is less likely, but there is some possibility you get there.'

Source

1 comment:

I stand to be corrected, but I believe that other historical ratios, such as average housing prices to historically adjusted real worth, are equally as askew. I hate to be doom and gloomer, but it looks like the proverbial chickens are coming home to roost.

Post a Comment